In

the process of developing my model for a better cryptocurrency system, I have returned and my attention is now dwelling on a concept for how to precisely regulate a currency that becomes extremely stable against the totality of the economy.

I have mentioned this before but right at the moment this is uppermost in my mind, and I am in this article attempting to attract some good criticism of the premises and conclusions so that this can be clearly justified (or rejected).

Something that is important is that I think I have devised a scheme for a cryptocurrency token issuance regulation system that would produce the most stable currency that the human race has ever seen.

Strangely it seems that I am the first to suggest this, even though all the evidence required to assemble and come to the conclusion I have come to is available for maybe at least 50 years. However, I will sketch it out for you in simple terms.

Velocity of Money

basically is the same thing that you see in exchange marketplaces called 'trading volume', except it includes every transaction involving a money in an economy. The more transactions, of more amounts of money, the greater this velocity is.

Normally there is a very strong correlation between the amount of money being exchanged back and forth in an economy, and the level of production. When the rate of production in the total economy rises, the amount of money traded for commodities increases, and vice versa.

So, here we are in the 21st century, and we have cryptocurrencies, which essentially are a transparent record of transactions involving a currency. We have massive clustered database systems that handle these transactions at a rate of tens and even hundreds of thousands of transfers per second (such as NYSE, NASDAQ, COMEX and others).

We are not short of data about the velocity of money in many marketplaces, though at this point most of them are wrapped up in the trade secrets of government chartered banking companies. Or simply nobody has thought to think about how this data could be used to determine the proper rate of issuance of new currency.

Issuing currency based on proof of payment

The central concept I have is that if you instead of setting some arbitrary rate of issuance, like Satoshi and his biannual rate halving, the Central Banks and their trade weighted indexes, and the like, or like here at Steem, where the insane experiment of 100% inflation was tried out and within 8 months ended because of how badly it was affecting the system, that instead, you issue currency based on proof of the volume of trade in some way.

There is an issue in this, that it might be exploited by people simply bouncing money back and forth between sock puppet accounts, so there would need to be measures that counter this attempt to exploit this system.

Countering exploitation

The easy way to do this would be that, like how Steem diminishes your vote power by frequency, in a similar way, based on a system-wide statistical normal, if your trade volume is far above normal, that it can be concluded that you are simply trying to milk the system by grabbing a maximum amount of the new currency issued based on this metric.

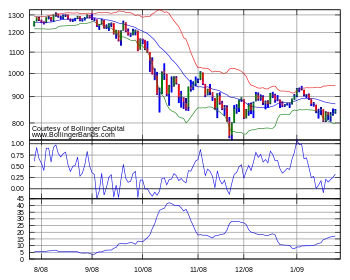

In statistics there is a concept called 'Standard Deviation' which is a measure of the occurrances of events within a system. Standard Deviations are commonly used in trading indicator algorithms, a notable one being Bollinger Bands.

This is a volatility indicator, and it basically creates a channel around the price movements that expands and contracts to show you the amount of volatility (the width of the up and down movement, correlated with two different moving averages). When the price breaks out of the bands, after they contract, it is a fairly reliable indicator of a rally (or panic).

The band is calculated based upon the Standard Deviation, the usual range that is calculated by charting applications is 2 standard deviations. When this range shrinks, and the price moves out of it, it usually rapidly trends in the direction of the side it breaks out of.

This was just by way of giving a visual way of explaining how market activity and statistical Standard Deviations look visually (which helps me understand it and I think also people in general understand it better when they see a picture - I see them inside my mind which is why also I tend not to produce a lot of pictures in my posts).

So, I think the anti-manipulation strategy that would work with a cryptocurrency that issues new tokens based on trade volumes would have three prongs:

The amount of currency issued based on a transaction reduces with the frequency of transactions against the Standard Deviation of the whole currency's users. The bigger the deviation of a user account's frequency and volume of transactions, the lower amount of new currency paid to them would become, and the rate at which the amount that can be issued increases with the frequency.

Note that this would would tend towards paying more new currency to the poorest accounts in the system.The evidence of the transaction volume must always be provided by a third party account whose relationships in in their transaction history outside of witnessing the transaction can be proven to be not associated by generating an association graph. That is, if the witness has any transactions with the two accounts involved in the transaction, the system will not issue currency at all for this transaction.

Note that this probably also would increase the amount that poorer users would earn in the inflation, because social networks tend to stratify by the amount of wealth.By building the currency as a model of a coin economy, with multiple denominations (powers of two) that cannot be split, the third party witnesses can perform an essential operation of providing change, that the have locked into a deposit asset similar to Steem Power, that can only be drawn down slowly, in performing this operation, they are paid a commission in the form of new currency issuance for this service to the economy.

The servers that run this cryptocurrency system would agree by a deterministic consensus process which of the change providers may perform the operation when a payment requires the 'breaking' of the coins. This would be both random as well as excluding this change operation from being done by provably associated accounts.

The details of the multi-denomination coin market model currency I will discuss in a future article, because I am in an intensive process of putting this concept together, but the sense I have at the moment is that this way of doing transactions will both reduce the total data requirement for the blockchain (a term that I am loathe to use, because my design really moves far beyond this), and enable the pruning of the records of the changes of ownership of tokens for light nodes on the network with low storage capacity (there will still be archival storage nodes that will keep the whole record, who can be consulted when there is uncertainty about the record).

General principles

Because, and it is well known, that money velocity is a vitally important metric of the health of an economy, and the real wealth represented by the currency within it, but up until the arrival of the internet and digital ledgers, it would have been difficult to implement. There would have been no countermeasures against exploitation, and centralised certification would have made it no different than the government granted monopolies on money production.

So, in an economy, the growth of real wealth, measured in terms of accumulating surpluses and increasing rates of production of commodities, fluctuates over time up and down. Most people understand that when supply is short, prices go up, and when there is too much supply, prices must go down.

However, money is a unique commodity in that it is involved as the counterparty in every transaction. The rate of supply of currency is vitally important, because too much money being issued and prices go up (inflation), and there can be a problem also when it goes the other way as well (deflation).

The problem of deflation

Now, even based on the average new computer on the market, this price point is mid-range, and it it was second hand. A new computer of marginally better capability at the time cost around $2000-3000.

The prices of computers is always going down because they are cheaper to build, and because people already have so many and the improvements in shorter terms are not so great. The problem with deflationary commodities is that they can dramatically drop in exchange value the moment the ink is drying on the printer making the receipt for the payment. So to speak.

This can cause a big problem for businesses because they have inventory that is rapidly declining in value against the currency. They are not perishable, but their market value decays as though they were.

However, contrary to what Central Banker paid economists say, a deflating currency encourages saving, which in fact lowers interest rates, but instead of letting this naturally occur with increased production, they artificially pump the supply of currency which ensures that supply never lags behind the growth in the real wealth. This causes excessive borrowing and speculation on highly unlikely or long term development processes which eventually turn out to be losers and the money is effectively destroyed.

So, a money should not be inflationary, or deflationary, if possible, though naturally due to population growth and the symmetry of money issuance, it has to be slightly inflationary (but the economy is also).

The only way this can be achieved is if the amount of new currency issued is tied to the real growth and contraction of the economy. It is the deceptive and dangerous belief that currencies should never deflate (continuously become more valuable) against commodities. However, this is nonsense, and the fact is that at times in history when money systems over a period of decades became more and more valuable, this was because the real economy was growing, and some of these eras even have labels like 'The Golden Age' such as the one in the Netherlands in the 15th century.

Conclusion

There is issues with preventing the gaming of a currency that is issued based on the volume of transactions, in that people can simply bounce currency around, and I have outlined some possible countermeasures for this, and I will be thinking about this more. I will also go into further detail in the future about the currency model that I made mention of, because I will be implementing this on the Dawn Network, once I have hashed out the details of the right way to do it.

We can't code here! This is Whale country!Vote #1 l0k1

Go to steemit.com/~witnesses to cast your vote by typing l0k1 into the text entry at the bottom of the leaderboard.

(note, my username is spelled El Zero Kay One or Lima Zero Kilo One, all lower case)