It truly is amazing when a thief can steal your money and make you like it. More on this later.

Tax Day is April 18th this year in the United States, but I'm sure many of you have already filed. Today I want to talk about why we have to pay income tax at all.

Prior to the ratification of the 16th amendment in 1913, the federal government tried - and was somewhat successful - in collecting taxes to fund various efforts. A 3-5% tax was levied on all individuals with incomes over $600 from 1861-1872 to help fund the Civil War.

The 1894 Tariff Act tried to make an income tax permanent, but Pollock vs Farmers Loan & Trust effectively ended that money grab. The 16th amendment, however, would finally place the weekly check of the American worker under the thumb of Uncle Sam.

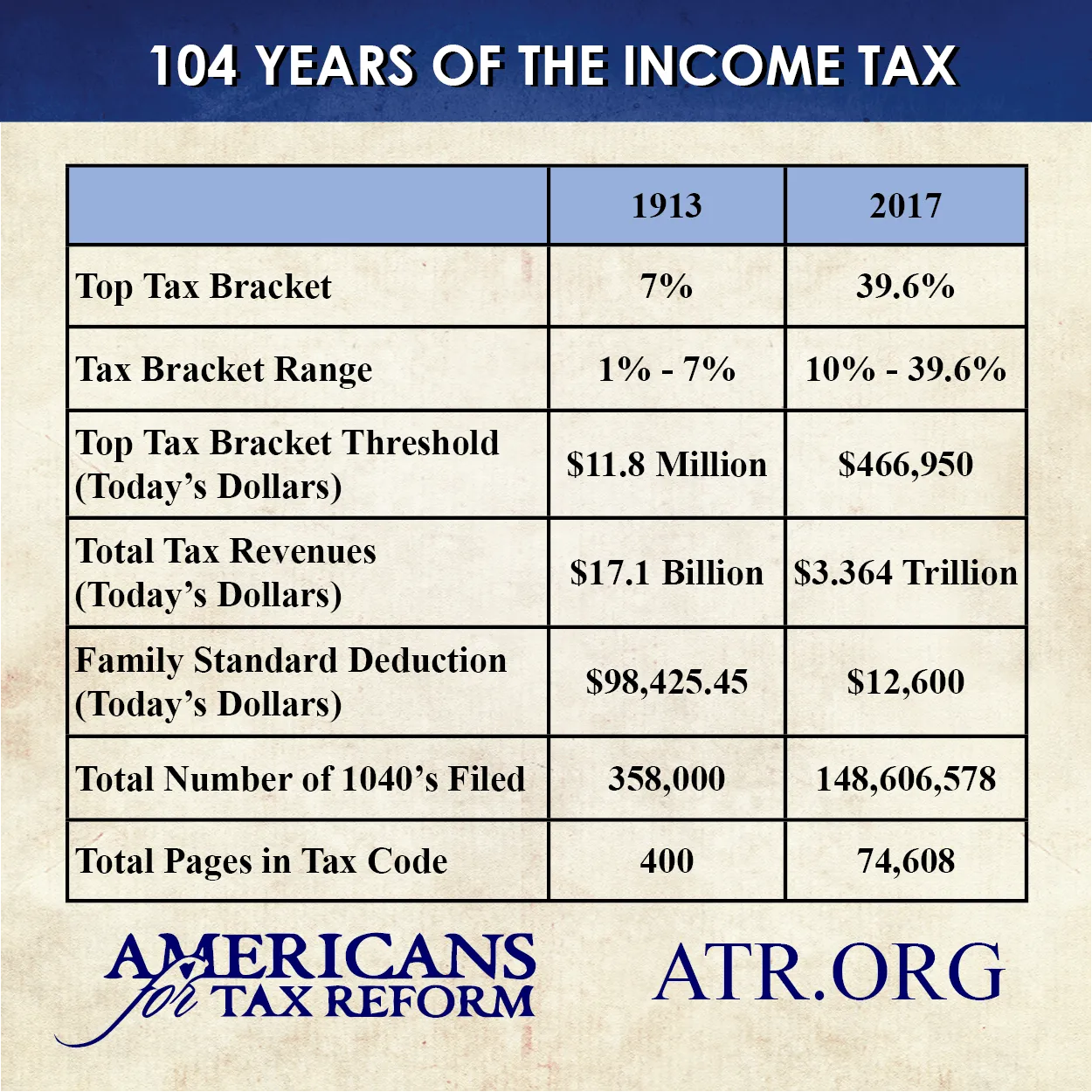

It started off - as things often do - in a meager fashion. A 1% tax on most incomes, with a 7% rate on incomes over $500,000. By 1918, the top marginal rate had risen to 77%. It dropped into the 25% range throughout most of the 1920's before finally peaking again at 94% in 1945.

After World War II, the United States its top marginal tax rate slowly decline into the %30-40 range. Payroll withholding, e-filing, TurboTax and other helpful technologies have also made the process less painful and time-consuming for workers.

In fact, some are excited come tax time as they receive large refunds due to varied credits and deductions set forth in the overwhelming tax code. They use their withholding as a sort of savings fund, paying off bills or making a luxury purchase with their refund.

Like the opening line of htis article stated, it truly is amazing when a thief can steal your money and make you like it.