In a recent conversation I had with fellow Hivean and Lion Joel Valenzuela, it was brought to my attention that it could be useful to have some easy to understand information about how the Hive currencies work and the mechanics of the reward system used to distribute these tokens to validators, stakeholders, content creators and curators.

We dug up some very useful articles from yesteryear and updated much of the information to create some cheat sheets that will hopefully be of useful to anyone who wants to get a better understanding of Hive.

I'm not by any means an expert, so it's possible that there are mistakes here. If you think this might be the case, please let me know in the comments below, and I'll gladly update the information in this post.

There are three assets on the Hive Blockchain:

HIVE

- Liquid, tradable on exchanges. At the time of writing, Hive is available for trade on the following exchanges:

- Can be transferred from an exchange into your wallet (use your account name as the address)

- Alternatively, it can be exchanged to $HBD in Hive’s internal market

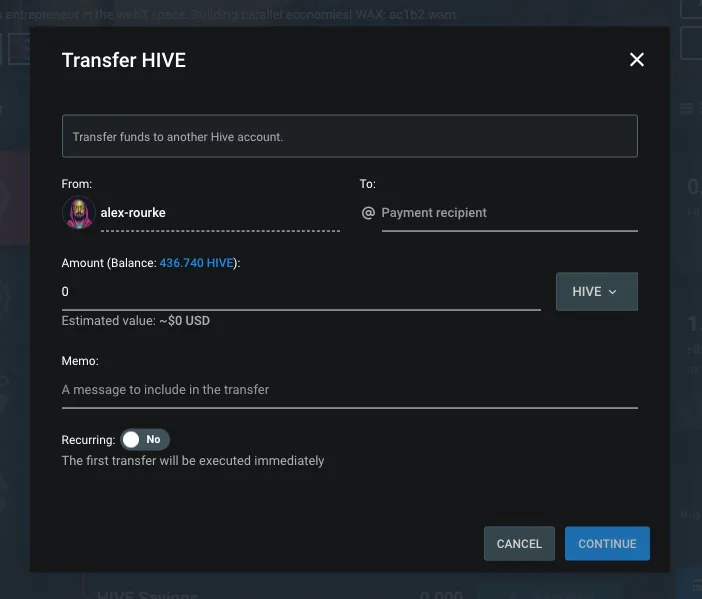

- Can be transferred to another Hive account using the transfer function in the wallet section of any Hive front end, mobile app or wallet extension such as Hive Keychain.

- Can be exchanged for assets on other chains such as Arbitrum, Bitcoin, Dash, Ethereum, Kuji, Mayachain and Thorchain using LEODEX decentralized exchange.

- Can be converted to SWAP.HIVE through services like beeswap and HIVE ENGINE. SWAP.HIVE is a wrapped version of HIVE on HIVE ENGINE, Hive’s smart contract layer with an independent P2P/Witness system operating 35 nodes in a network. The first smart contract being introduced is the ability to quickly and easily create custom tokens with no coding required. SWAP.HIVE can be exchanged with other layer 2 tokens such as LEO, BRO, BEE and other popular L2 tokens used by tribes, games and other dapps. Another use for HIVE ENGINE tokens are the creation of liquidity pools, which can be accessed through Tribaldex and Beeswap.

- Hive inflation is one of its key monetary features. It was set with a decreasing inflation model that started at 8% per year in March 2020 (when the blockchain forked from Steem) and decreases at a rate 0.01% per 250,000 blocks until it reaches 0.95%. Block production on Hive happens every 3 seconds.

Hive's distribution mechanism

The Hive blockchain distributes newly minted tokens through something that was at some point known as Proof of Brain (PoB) mechanism, designed to reward content creators, curators, and other stakeholders for their contributions to the ecosystem. Here’s a breakdown of how Hive distributes its inflationary rewards.

Let's first look at some key factors

Inflation Rate:

The Hive blockchain uses a declining inflation model:

Starting from ~8% annually in March 2020 (after the Hive fork from Steem). Decreasing by 0.01% per every 250,000 blocks or approximately 0.5% annually until it reaches a fixed 0.95% annual inflation rate in the long term.

Block Time:

Hive has a block time of 3 seconds. This means approximately 20 blocks are created per minute, 1,200 blocks per hour, and 28,800 blocks per day.

Inflation Allocation:

Newly minted tokens are into different groups: content rewards, witnesses, and the Decentralized Hive Fund (DHF). We'll look at the exact percentages in just a moment.

At the time of writing, the current HIVE supply is 459,970,969.512 tokens (source: hiveblockexplorer.com) with an estimated inflation rate of 6% in 2024. As mentioned above, Hive has a 3 second block time, so the blockchain produces about 20 blocks per minute or about 10,512,000 blocks per year:

20blocks/min×60min/hr×24hrs/day×365days/year = 10,512,000

If we take the current supply x the expected inflation rate we can calculate how many HIVE tokens are created per year (approximately):

459,970,969×0.06 = 27,598,258 HIVE per year (approx.)

27,598,258 Hive per year / 10,512,000 blocks per year ≈2.62HIVE per block.

These are distributed in the following manner:

65% to Reward Pool (Content Creators & Curators):

2.62 × 0.65 = 1.70 HIVE per block10% to Witnesses:

2.62 × 0.10 = 0.26 HIVE per block15% to Staking Incentives (if applicable):

2.62×0.15 = 0.39 HIVE per block.10% to the Decentralized Hive Fund (DHF):

2.62×0.10 = 0.26HIVE per block.

These Hive rewards are not paid out in liquid tokens. They're paid out in a combination of

- Hive Power (HP)and

- Liquid HBD (Hive Backed Dollars)

We'll explain these in detail now.

HIVE POWER (HP)

- Not liquid, implies long term commitment to the Hive network

- Of newly created Hive, 10% goes to Hive Power holders. Holding Hive Power is akin to holding shares of a company. The Hive network distributes a portion of newly minted tokens to HP holders proportionally to the size of their holdings. At the time of writing, the approximate APR% you’ll receive for holding Hive Power is 2.95%

- Can be acquired by powering up liquid HIVE in your wallet

- Can be acquired if another account powers up their liquid HIVE to your account as a form of reward or payment.

- Can be delegated, which means account A can temporarily or indefinitely assign a portion or the totality of its voting power to account B without the funds leaving account A's wallet. This can be useful for governance as well as curation. In fact, many curation guilds accept HP delegation from users in exchange for a portion of the curation rewards. Some curation guilds include OCD and Curangel.

- It takes 13 weeks to be converted to HIVE through a process called powering down. Once the power down process has been initiated, you will receive 1/13th of your powered down amount every 7 days. This slow power down was implemented as a security feature. If a malicious actor were to steal your keys and initiate a power down in an attempt to steal your funds, you would have time to restore your account and change your keys before any funds are withdrawn.

HIVE Backed Dollars ($HBD)

- Liquid, tradable on Hive’s internal market.

- Designed to have stable value of about $1.

- One of the mechanisms that helps achieve this is the DHF (Hive's DAO)-funded @hbdstabilizer bot that uses HIVE to purchase HBD when it is possible to do so for less than 1 USD and sellss Hive for HBDs when the price is above $1.00. Whatever sales/ buys/ conversions are made, the HIVE/ HBDs are always returned to the @hive.fund account, the Hive DAO account

- Pays holders 15% annual interest when placed in savings. $HBD in savings (staked) are held in your account, under your custody. All you need to do look for a dropdown menu in your favorite Hive front end and click on “stake HBD” or “transfer to savings”. To withdraw $HBD from savings you can simply click on unstake. This process includes a 3-day waiting period.

- Can be converted to HIVE right in the wallet. Each $HBD is converted to $1 worth of HIVE. Conversion takes 3.5 days and the price is median price over that period.

- Like HIVE, $HBD can be transferred to another Hive account using the transfer function in the wallet section of any Hive front end, mobile app or wallet extension such as Hive Keychain.

Hive Rewards cheat sheet

This Cheat Sheet summarizes various aspects of Hive rewards for authors and curators. It is designed to be short and informative; for detailed explanation check out links at the end of this post.

Hopefully you’ll find it a useful reference. If something is missing or can be improved, please let me know!

On Hive, valuable content is rewarded by the community. Whether it’s a long-form blog posts, a comment or one of various short-form interfaces such as INLEO Threads, Ecency Waves or PeakD Snaps. The exact amount of the reward depends on a couple of factors:

- The total Hive Power of curators (people who have voted for the post or comment)

- The weight each curator has given to their vote during the voting period or reward window, which lasts for 7 days from the moment the author publishes de post. Positive vote weight can be adjusted via a slider to have anywhere from 1% to 100% vote weight.

Similarly, negative votes can be adjusted to carry anywhere from -1% to -100% vote weight.

Voting power or “voting mana” decreases as curators vote, and recharges gradually while they don’t. If you start with 100% voting mana, if you vote with 100% voting weight, then it will deplete by 2%, so the new voting mana will be 98%. So when voting next at 98% with full weight then it will again deplete by 2% of the voting mana. So the new voting mana will be (98-(98*0.02))= 96.04%. And so on.....

| Number of votes with full vote weight | Voting mana |

|---|---|

| 0 | 100 |

| 1 | 98 |

| 2 | 96.040 |

| 3 | 94.119 |

| 4 | 92.237 |

| 5 | 90.392 |

| 6 | 88.584 |

| 7 | 86.813 |

| 8 | 85.076 |

| 9 | 83.375 |

| 10 | 81.707 |

You get the idea.

If you'd like to see how much your vote value is at any given time and how long it will take to recharge, you can check it on hivestats.io

As well as block explorers such as https://hivexplorer.com/

When the reward window is finished, the post will no longer eligible for votes and the amount earned will be distributed as follows:

- 50% goes to the author and is paid out in Hive Power and $HBD in equal proportions.

- 50% goes to curators. This part is paid 100% in Hive Power. How exactly it is divided between the curators depends on how much voting power each curator has at the time of voting.

Note that no payment may be less than 0.001 Hive Power or Hive Backed Dollars ($HBD)

Further Reading:

- If you’re unsure about what Hive Power or Hive Backed Dollars ($HBD) are, check this @peterz/steem-currency-cheat-sheet

- Hive whitepaper discusses author rewards in the Subjective Contributions section, but beware: things have changed since its publication

- For a historical breakdown of how the Reward Calculus was originally designed, see this 6-piece series by @theoretical:

Credits: The original information in this article was written by @peterz on August 5th 2016 prior to the Hard fork from Steem blockchain. Much of the information has been updated to reflect the current aspects of Hive, its mechanics and the tools the Hive ecosystem interacts with.

Posted Using InLeo Alpha